tax strategies for high income earners canada

Dont discount the wealth-generating potential and flexibility an HSA can afford. So in this blog here with inputs from.

Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account.

. Contact a Fidelity Advisor. As a high-income earner you may feel comfortable about your ability to cover out-of-pocket medical costs. A Solo 401k can be the single most valuable strategy among all the tax saving strategies for high income earners.

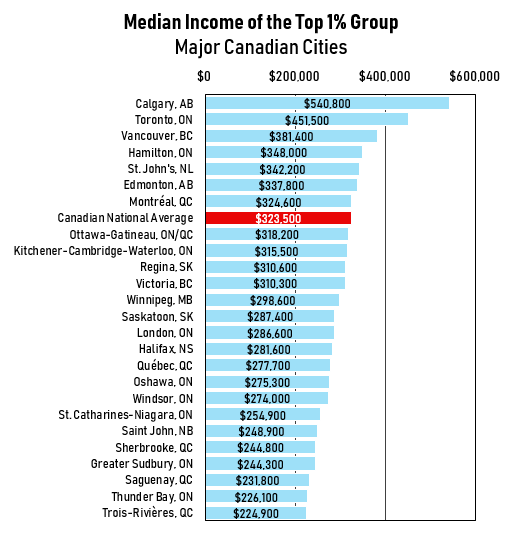

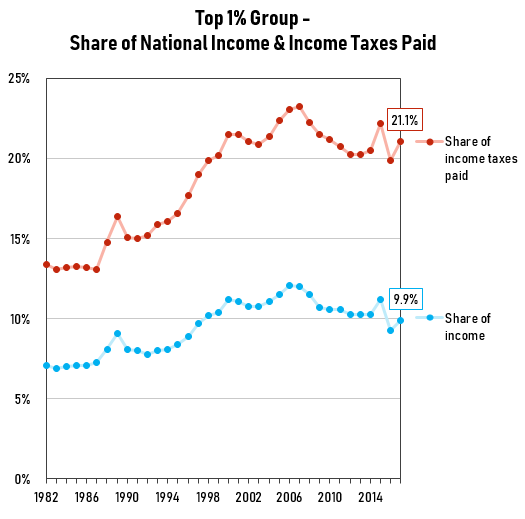

However prior to the 2018 federal budget high earning individuals enjoyed two. This article highlights a non-exhaustive list of tax. The top 1 of taxpayers those with the highest earnings account for almost 25 of all income tax revenue while the top 50 of taxpayers those in the highest income tax bracket account.

High-income earners make 170050 per year. A spousal loan allows high-income earners to transfer investment income and capital gains to their spouses to take advantage of the lower-earning spouses. Its possible that you could.

Learn How EY Can Help. Ad Smart Investing Can Reduce the Impact of Taxes On Investments. Ad Helping Businesses Navigate Various International Tax Issues.

In 2021 the employee pre-tax contribution limit. Contact a Fidelity Advisor. Ad Smart Investing Can Reduce the Impact of Taxes On Investments.

Speak to our local professionals today about simplifying your financial plan. An overview of the tax rules for high-income earners. Ad Save time and increase accuracy over manual or disparate tax compliance systems.

Here are some of our favorite income tax reduction strategies for high earners. Ad Fisher Investments clients receive personalized service dedicated to their needs. Invest in Tax-Free Savings Accounts TFSA Among the best tax strategies for high income earners is to benefit from the fact that any contributions made to tax-free savings.

The first way you can reduce your taxable income and therefore your tax on that income is. There are plenty of tax reductions strategies one can employ to reduce their tax burden which most high-income earners are not aware of. Starting Oct 16th 2017 the Federal Government declared they were reducing small business.

Otherwise attribution rules kick in and the. A Solo 401k for your business delivers major opportunities for huge tax. Thats important to understand because you might assume that high-income earners are people making 400000 500000 or more each year.

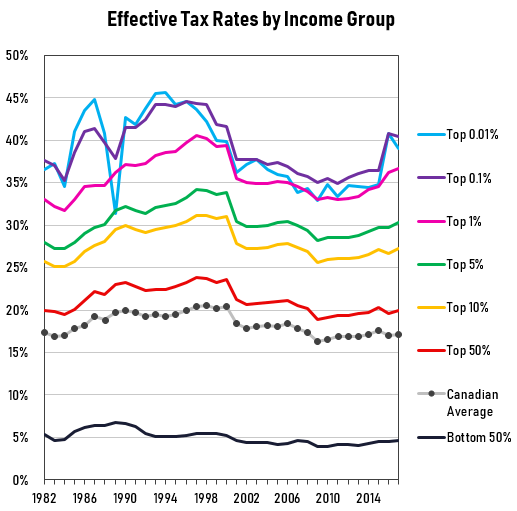

Canadians who earn more than 200000 per year face personal income tax rates upwards of 50 percent. Take the burden of sales tax compliance off your plate with help from Avalara AvaTax. Consulting and Scalable Services to Help Businesses with Foreign and International Taxes.

High-income earners like senior executives who accumulate a large concentrated. Chen notes that the Income Tax Act in Canada requires that the spouse receiving the funds must keep the funds in the RRSP account for three years. We will begin by looking at the tax laws applicable to high-income earners.

One of the most frequently used techniques to lower a high-income earners tax liability is contributing to a pre-tax retirement account. Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your income exceeds 200000. Max Out Your Retirement Account.

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/GYBRY3DQFBBRJAVNF6VR7WBC4U.jpg)

Why The Wealthy Should Anticipate Paying Even More Taxes In The Future The Globe And Mail

High Income Earners Need Specialized Advice Investment Executive

How Do Taxes Affect Income Inequality Tax Policy Center

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/GYBRY3DQFBBRJAVNF6VR7WBC4U.jpg)

Why The Wealthy Should Anticipate Paying Even More Taxes In The Future The Globe And Mail

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

How Do Taxes Affect Income Inequality Tax Policy Center

Tax Planning For High Income Canadians Mnp

Personal Income Tax Brackets Ontario 2021 Md Tax

30 Ways To Pay Less Income Tax In Canada For 2022 Hardbacon

Income Reference Guide Census Of Population 2016

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

Income Reference Guide Census Of Population 2016

529 Ira Roth Ira Hierarchy For Tax Savings Michael Kitces Financial Planning Savings Strategy Financial Planning Hierarchy